State Withholding Tax Table 2025 - 2025 Tax Brackets Calculator Nedi Lorianne, The finance minister presented the interim budget 2025, which focuses on infrastructure and investment. The current withholding tax rate is 5% for individuals serving as directors. Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Mississippi provides a standard personal exemption. 2025 michigan income tax withholding tables.

2025 Tax Brackets Calculator Nedi Lorianne, The finance minister presented the interim budget 2025, which focuses on infrastructure and investment. The current withholding tax rate is 5% for individuals serving as directors.

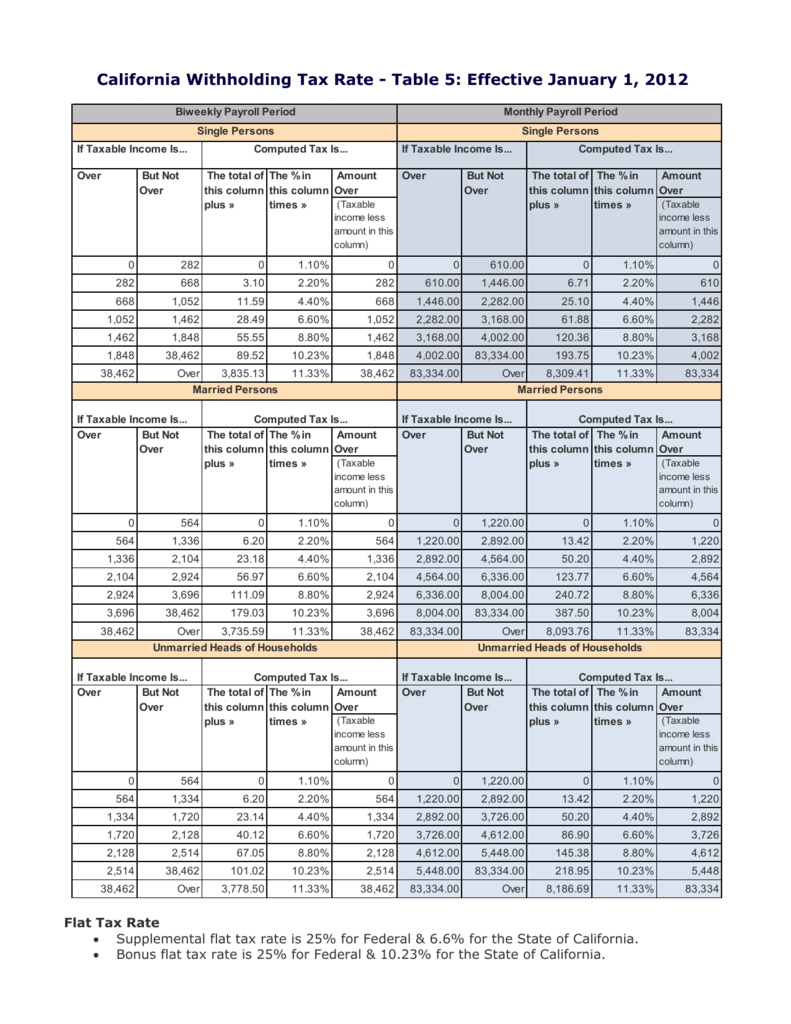

Tax rates for the 2025 year of assessment Just One Lap, California provides two methods for determining the amount of wages and salaries to be withheld for state personal income tax: 2025 tax calculator for texas.

Revised withholding tax table for compensation Tax table, Tax, The current withholding tax rate is 5% for individuals serving as directors. 501 high street, station 23b.

Tax Withholding Tables For Employers Elcho Table, Oklahoma income tax withholding tables. This edition of withholding tax facts ofers information about filing your employer withholding tax forms, reconciliation statement and other employer withholding related.

Maximize Your Paycheck Understanding FICA Tax in 2025, The 2025 tax rates and thresholds for both the texas state tax tables and federal tax tables are comprehensively integrated into the texas tax. Need help with your taxes?

California state income tax tables in 2025. This publication contains information regarding withholding tax filing requirements based on the tax law as of january 1, 2025.

Mississippi provides a standard personal exemption.

Nys Withholding Tax Forms 2022, The tax tables below include the tax rates, thresholds and allowances included in the arkansas tax calculator 2025. And tax tables start using this booklet jan.

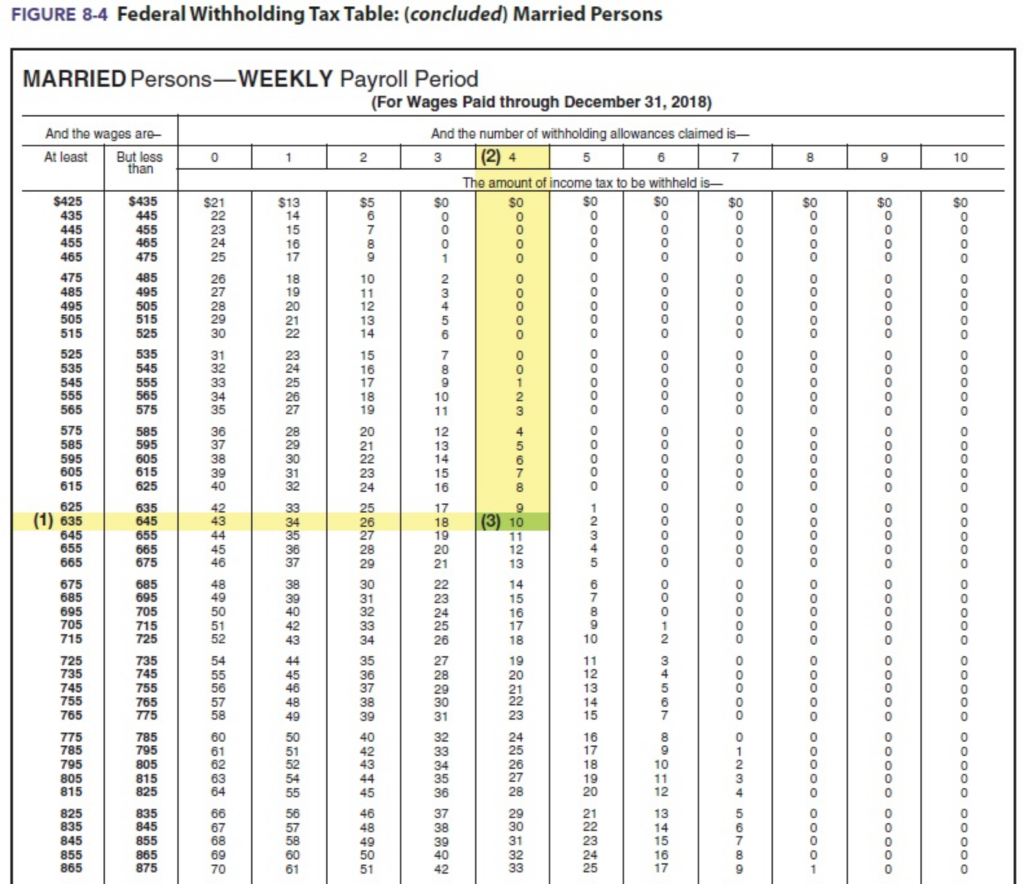

Federal Tax Withholding Tables Weekly Payroll Awesome Home, 34 states have 2025 state tax changes taking effect on january 1st, including state income tax changes and state business tax changes. And tax tables start using this booklet jan.

The current withholding tax rate is 5% for individuals serving as directors.

Withholding Tax Table Vendor FEQTUNG, This publication contains information regarding withholding tax filing requirements based on the tax law as of january 1, 2025. California provides two methods for determining the amount of wages and salaries to be withheld for state personal income tax:

Withholding Tax Table, A senate panel accused pwc of trying to cover up the tax leaks scandal. Linda burney welcomed the alice springs curfew as a “circuit breaker”.

State Withholding Tax Table 2025. California provides two methods for determining the amount of wages and salaries to be withheld for state personal income tax: 2025 tax calculator for texas.

California provides two methods for determining the amount of wages and salaries to be withheld for state personal income tax: